Social Security Video Hearings in New York

Hi, I’m Dave Herman and today we’re going to talk a little bit about Social Security video hearings. Although Social Security has been holding video hearings for a number of years, they very recently changed the regulations so that if somebody wants a live hearing, which is with a judge, face-to-face, it’s necessary to object to the option of the video hearing within 30 days of receiving that notification. This is led to a greater awareness of the program. But it has also resulted in a lot of misinformation that we will try to deal with in this video.

Video Hearing Process

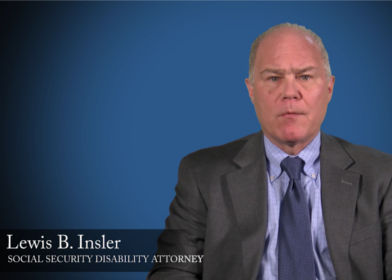

First of all, if you object, in time, to a video hearing, you as a claimant still have an absolute right to a personal hearing. Which means that you, me as your attorney, and the judge are all in the same place. A video hearing means that while you – and I as your attorney – are in the same place, the judge is somewhere else and the hearing is connected through an audio/video connection. The judge at a video hearing may or may not be from your local hearing office. This means that it could either be the hearing office that is generally located near your home or it could be a judge that is off-site at one of the national hearing offices or in a hearing office that is perhaps, less bogged-down with case load.

In that case although the original judge may keep the case and conduct the hearing as a video hearing, unless the claimant chooses to return, the hearing may be by video, even if the claimant had originally objected. We have found that judges seem to have the same approval rates, whether it’s by video or by a live hearing.

Objecting to Video Hearings

But when the program first started, we and many other firms, objected to the video hearings because we thought it would be easier for judges to deny claims that were not in person, even though the claimant was not told of the decision at the end of the hearing. At this point, we are objecting to video hearings in the majority of our cases because we want the hearings to be with local judges who we know respect us.

In some cases where we know the hearing will be away from the main hearing office, but will be heard by the local judges, we won’t object to the video hearing because, as we noted, the judges already know us. But more important, we know that if we object to a video hearing, the wait for a hearing will be even longer because the hearing is not being scheduled live in those locations.

Demanding Live Hearings

Even in those cases though, sometimes we want a live hearing no matter where or how long the hearing delay is, because some impairments are not suited for video hearings. Obviously, in hearing loss cases as well as in certain psychological cases, having a claimant face-to face with the judge, so that the judge can get a sense of the claimant, is critical.

As your attorney, we will decide, based on our experience and using our discretion, whether it is appropriate to object to a video hearing and demand an in-person hearing or whether we will consent to a video hearing. If we find that our client’s hearings are being scheduled to out of town judges who don’t know us, we are far more likely to object to the hearing. Before we make that decision, we generally still look at where these off-site judges are from, what their approval rates are, and sometimes we will even contact our colleagues around the country, to get a sense from them of the kind the judge that we will be in front of.

Local Judges in New York

Social Security uses video hearings as an effective way to manage their judge’s case loads. As your attorney however, we are far more concerned with your case. You retained us to win, and we want to win as soon as we can. We want to be sure that we maximize your chance of success. Everything we do is directed toward that goal. We do feel that local judges give you a better chance of success in most, but not all cases.

Whether or not we object to a video hearing, that is a factor of who we think will be handling the case. We can’t decide who the judge will be. But it is often the case, that the judge we know, is a better option than one we don’t, because we can prepare you and your case for how we know that judge conducts his or her hearings. While we still think that a in-person hearing is preferable, we understand the realities that our clients can’t wait for hearings, and we therefore decide, on a case-by-case basis, whether or not to object to the video hearing for our clients.

By: Gabe Hermann